Japanese game development splits starkly between giants (Sony, Nintendo, Capcom) and everyone else. Nihon Falcom – Trails series creator – embodies mid-tier struggle perfectly. FY2025 revenue hit ¥14.1 billion ($92 million USD) despite Kuro no Kiseki topping 1 million sales worldwide. Compare to EA ($7.5B), Ubisoft ($2.1B), even niche HoYoverse ($3B Genshin Impact alone). Japanese RPG specialists simply cannot scale Western/Chinese production models.

Revenue Reality Check

Falcom’s 2025 peak represents lifetime high serving 35-year niche. Capcom generates that quarterly through Monster Hunter. Square Enix earns 40x yearly despite Final Fantasy flops. Western mid-majors (Larian $1B+ Baldur’s Gate 3, Remedy $100M Control 2 budget) operate entirely different financial universes.

Trails sold 8 million lifetime across 20+ titles since 2004 – averaging 400k per game. Kuro no Kiseki’s 1M milestone took 18 months despite universal 90+ metacritic acclaim. Persona 5 Royal hit 4M faster. Yakuza Like a Dragon needed 2 years. Niche RPG math brutally unforgiving.

| Studio | FY2025 Revenue | Flagship Sales | Employees |

|---|---|---|---|

| Nihon Falcom | $92M | 1M (Kuro) | 320 |

| Capcom | $1.3B | 10M+ (MH Wilds) | 3,200 |

| Square Enix | $3.2B | 4M (P5 Royal) | 5,000 |

| Larian | $1B+ | 20M (BG3) | 400 |

Structural Barriers Lock Them Out

Japan’s console-centric culture kills PC-first breakout strategy. Falcom’s Steam Trails ports arrive years late, missing live service/multiplayer wave. Western success (Baldur’s Gate 3, Hades 2) demands simultaneous global launch across platforms. Kuro no Kiseki PC debuts 2026 – competing against GTA 6, Witcher 4.

Team size cripples scope. Falcom’s 320 staff matches single Western AAA project. Trails development cycles 2-3 years per mainline despite 60+ hour runtimes. Capcom allocates 200+ per Monster Hunter expansion alone. Budget disparity forces 10-year graphical parity with Western 2020 releases.

Genre Trap Devastating

JRPG formula resists Western tastes despite Persona breakthroughs. Trails demands 200+ hours cross-title continuity – prohibitive entry barrier. Kuro no Kiseki’s Erebonia Arc finale alienates newcomers despite self-contained story. Persona 5 succeeded through stylish gameplay minimizing reading. Falcom doubles down on novel-length cutscenes.

Multiplayer drought kills replayability. No co-op, no raids, no battle passes. Live service era passed Falcom entirely. Kuro performance pass offers cosmetics only – no engagement loops matching Warframe, Destiny 2 retention. Single-player RPGs face brutal day-one dropoff post-credits.

Global Giants Crush Distribution

Sony/Nintendo platform fees consume 30% revenue upfront. Falcom pays ¥500M+ annually across PS5/Switch ports alone. Western self-publishers (Supergiant, Larian) retain Steam’s 30% max – reinvesting directly into marketing/ports. Japanese publishers bleed storefront tax without equivalent promotional support.

Marketing non-existent outside niche. Kuro no Kiseki Western launch relied entirely word-of-mouth. Capcom spends $100M+ Monster Hunter campaigns globally. Falcom’s total yearly marketing budget wouldn’t cover single E3 booth. Discoverability dies instantly amidst AAA noise.

Success Stories Rare Exceptions

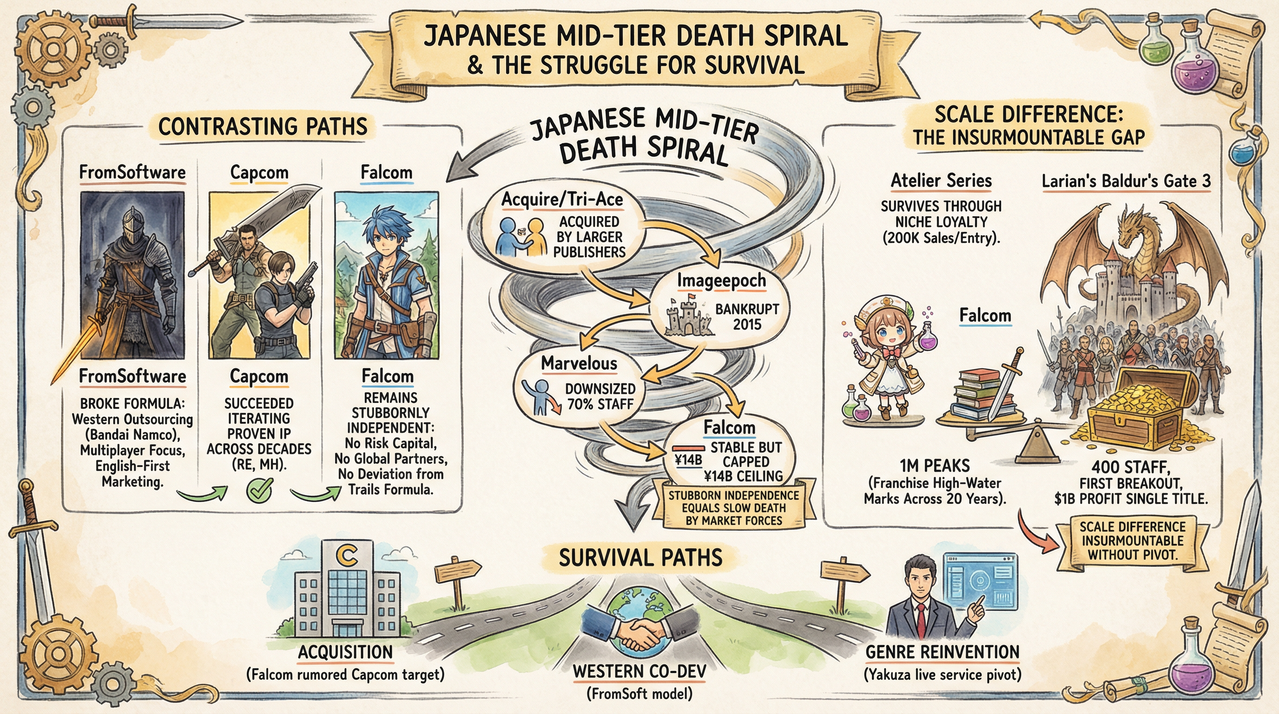

FromSoftware broke formula through Western outsourcing (Bandai Namco), multiplayer focus, English-first marketing. Capcom succeeded iterating proven IP (Resident Evil, Monster Hunter) across decades. Falcom remains stubbornly independent – no risk capital, no global partners, no deviation from Trails formula.

Atelier series survives through niche loyalty (200k sales/entry). Falcom’s 1M peaks represent franchise high-water marks across 20 years. Contrast Larian’s Baldur’s Gate 3 – 400 staff, first breakout, $1B profit single title. Scale difference insurmountable without existential pivot.

Japanese Mid-Tier Death Spiral

- Acquire/Tri-Ace: Acquired by larger publishers

- Imageepoch: Bankrupt 2015

- Marvelous: Downsized 70% staff

- Falcom: Stable but capped ¥14B ceiling

Survival demands acquisition (Falcom rumored Capcom target), Western co-dev (FromSoft model), or genre reinvention (Yakuza live service pivot). Stubborn independence equals slow death by market forces.