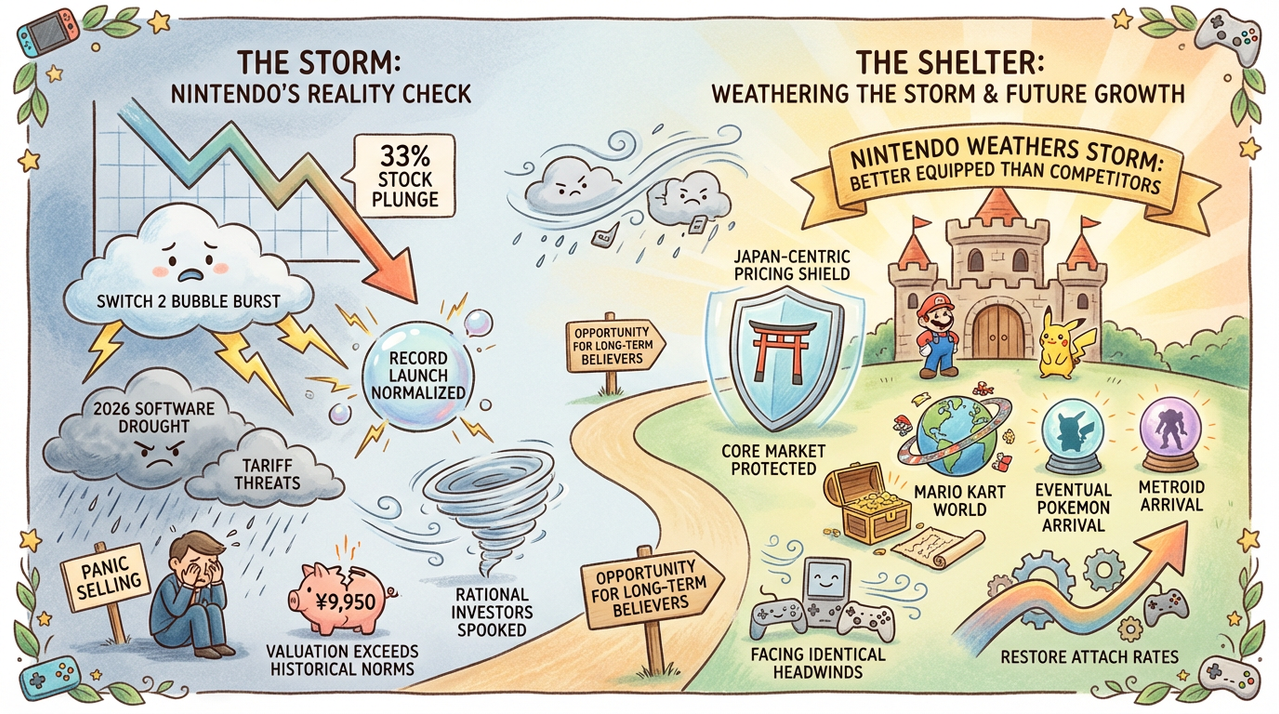

Nintendo’s dream year turned nightmare. After Switch 2 smashed launch records, shares cratered 33% in five months – from August 2025’s all-time high of ¥14,795 ($93) to January 13’s ¥9,950 ($62) trough. Investors flee citing holiday sales slowdown, absent major 2026 titles, and looming US tariff price hikes threatening profit margins.

The Swift Collapse Timeline

August 2025: Switch 2 sells 10M+ units globally, shares hit historic ¥14,795 peak

January 13, 2026: Shares crash to ¥9,950 – lowest since April 2025

33% total decline in five months

GameSpark analysis identifies three triggers:

- Sales Normalization: Switch 2 holiday attach rate underwhelmed

- Software Drought: No Pokemon Z-A, Metroid Prime 4 until late 2026

- Tariff Panic: Trump policies threaten 50% hardware cost increase

Switch 2 Reality Check

Launch euphoria faded fast. June 2025 debut delivered record-breaking 10.36M units by November, surpassing original Switch trajectory. Holiday season disappointed – no ‘killer app’ drove attach rates while competitors launched major tentpoles.

| Metric | Switch 2 (6 months) | Switch 1 (6 months) |

|---|---|---|

| Hardware Sales | 10.36M | 8.2M |

| Software Attach | 3.2 games | 4.1 games |

| Price | $449 | $299 |

Higher price point eroded value perception absent must-have exclusives.

2026 Software Black Hole

Investors panic over thinnest first-party slate in years:

- Pokemon Legends Z-A: Late 2026 (delayed)

- Metroid Prime 4: Holiday 2026

- Mario Kart World: Q1 2026 (only confirmed tentpole)

- No Zelda successor announced

Kantan Games CEO Serkan Toto warns “no major Western game” killed holiday momentum. US/EU discount programs signaled demand weakness – unprecedented Nintendo pricing strategy.

Tariff Time Bomb

Trump administration tariffs threaten catastrophe. Vietnam/Cambodia manufacturing faces 50% duties – exactly matching Switch 2 US price premium over predecessor. President Furukawa confirmed “tariffs become cost passed to prices” policy.

- Current: $449 US / ¥49,980 Japan

- Post-tariff: $500+ US possible

- Japan model: ¥49,980 (24% sales unaffected)

RAM price surges compound crisis – Switch 2 memory costs doubled since production.

Historical Context

Current ¥9,950 remains higher than pre-Switch era (¥2,400 in 2017). Wii peak never exceeded ¥7,000. Recent high represented bubble following record Switch 2 launch – analysts anticipated correction.

Switch 2 outperforms predecessor at six months despite headwinds:

- Hardware: +26% vs Switch 1

- Profit margins: Compressed by $150 premium

- Software: Lacks Mario/Odyssey-caliber launch

Investor Panic vs Reality

Dr. Toto clarifies context:

¥14,795 represented bubble peak. ¥10,220 today exceeds historical norms. Investors overreacted to normalization after unprecedented launch.

Nintendo maintains ¥18T market cap – world’s most valuable gaming company. Switch 2 trajectory exceeds analyst forecasts despite attach rate concerns.

FAQs

Is Nintendo in financial crisis?

No. 33% correction follows bubble peak. Current valuation exceeds historical highs despite sales normalization.

Will Switch 2 raise prices?

Likely. Furukawa confirmed tariff costs pass to consumers. US $500+ pricing expected post-tariffs.

What’s causing investor panic?

Holiday attach rates disappointed, 2026 lacks killer apps, tariffs threaten margins, RAM costs doubled.

Has Switch 2 underperformed?

No – 10.36M units crushes Switch 1’s 8.2M at six months despite $150 price premium.

When do major 2026 games arrive?

Mario Kart World (Q1), Pokemon Z-A (late), Metroid Prime 4 (holiday). Thinnest slate in years.

Are tariffs confirmed?

Trump policies target Vietnam/Cambodia manufacturing – 50% duties match exact Switch 2 US premium.

Should investors panic?

Correction expected post-bubble. Nintendo fundamentals remain strongest in industry.

Conclusion

Nintendo’s 33% stock plunge reflects reality check after Switch 2 bubble. Record launch normalized while 2026 software drought and tariff threats spook rational investors. ¥9,950 valuation exceeds historical norms – panic selling creates opportunity for long-term believers. Mario Kart World, eventual Pokemon/Metroid arrivals restore attach rates while Japan-centric pricing shields core market. Nintendo weathers storm better equipped than competitors facing identical headwinds.