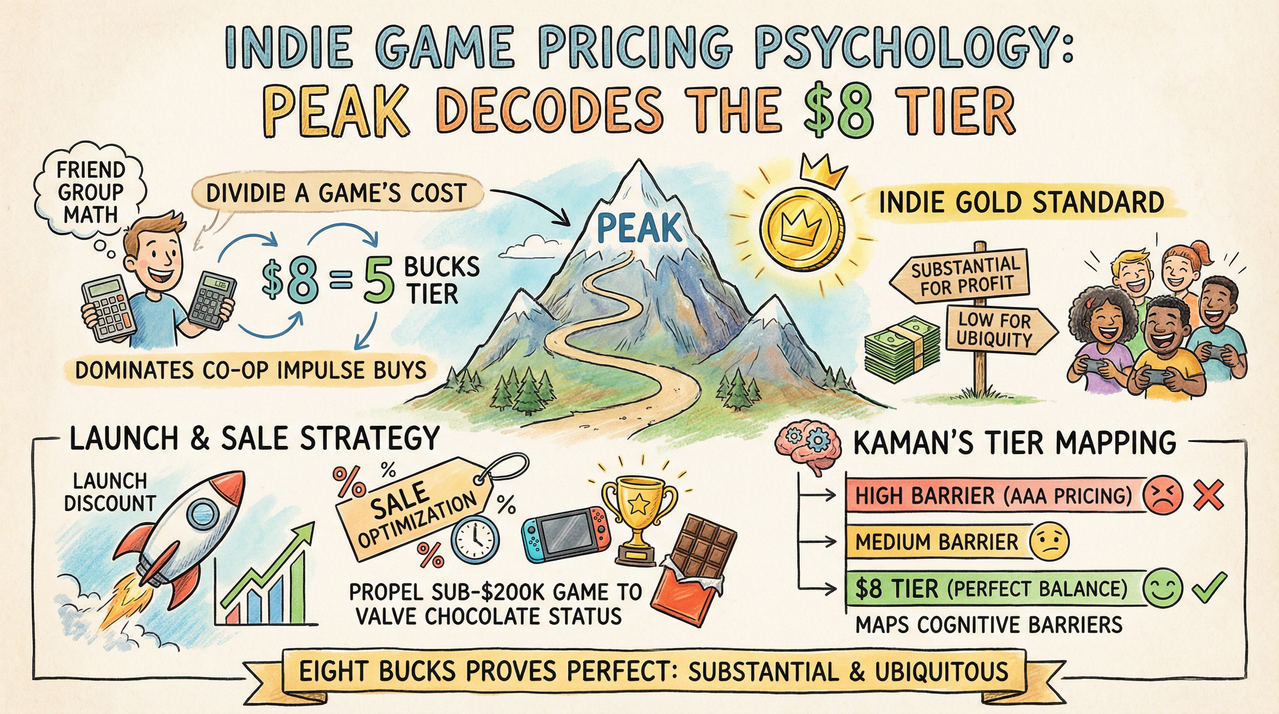

Indie pricing solved. Peak co-creator Nick Kaman detailed psychological price tiers explaining the co-op climbing hit’s $7.99 MSRP: eight dollars registers as five bucks, creating maximum discount perception when dropped to $4.95 sales. Strategy propelled 2 million copies sold under $200K budget.

Launched June 2025 by former Landfall devs, Peak blends Content Warning chaos with climbing physics across destructible mountains. Kaman’s Game File interview popularized ‘pricing vibes’ theory born as dev room joke but validated through sales data – $8 avoids $10 mental threshold while sale drops deliver biggest perceptual value.

Peak’s Pricing Tiers

| Actual Price | Player Perception | Sale Impact |

|---|---|---|

| $2 | Basically free | Minimal uplift |

| $3-6 | Five bucks range | Impulse sweet spot |

| $8 ($7.99) | Still five bucks | $5 sale = 37% discount |

| $12 | Ten bucks | Moderate discount |

| $13+ | Fifteen bucks | Luxury barrier |

Launch Strategy Success

Peak executed textbook rollout:

- Launch: $4.99 (38% off $7.99 MSRP) = impulse buy

- Current: $4.95 Steam sale (lowest ever)

- Valve Chocolates: $800K+ revenue club

- Total Sales: 2M copies under $200K cost

Inspired by Content Warning’s identical $7.99 strategy, Peak maximized friend group purchases – perfect four-player co-op price point.

Psychological Price Anchoring

Kaman’s tiers map cognitive thresholds:

- $5-8 cluster: Impulse/co-op sweet spot

- $10-12 cluster: Solo indie acceptable

- $15+ threshold: AA territory risk

- Sale drops within cluster maximize value perception

Industry Validation

Peak joins proven case studies:

- Content Warning: Identical $7.99, 6M+ players

- Gunpoint: Tom Francis polls players directly

- Lethal Company: $9.99 viral success

- Balatro: $14.99 premium indie breakthrough

Contrast AAA creep ($60→$70→$80) validates sub-$10 co-op dominance.

Development Efficiency

Peak proves small-team viability:

- Budget: Under $200K total

- Team: Landfall alumni core

- Cycle: Rapid post-Content Warning

- Marketing: Word-of-mouth + Steam Next Fest

Steam Economy Context

Valve’s chocolate threshold reveals:

- $800K+ annual = top 1% indies

- Peak hit immediately post-launch

- $8 MSRP optimizes Steam 30% cut

- Frequent sales maintain visibility

FAQs

Is $8 really psychologically $5?

Kaman’s tiers validated by 2M sales. $7.99→$4.95 feels 37% discount vs $15→$10 (33%).

Why not permanent $5?

Sale perception stronger from $8 base. Launch discount established impulse tier.

Valve chocolates real?

$800K+ revenue milestone. Peak received immediately post-launch.

Co-op pricing advantage?

$8 perfect four-player split ($2 each). Friend group impulse optimized.

AAA pricing contrast?

$70+ feels $100 psychologically. Indie sub-$10 owns impulse market.

More games copying strategy?

Content Warning identical success. Expect $7.99 co-op proliferation.

Conclusion

Peak decodes indie pricing psychology – $8=5 bucks tier dominates co-op impulse buys. Launch discount, sale optimization, friend group math propel sub-$200K game to Valve chocolate status. Kaman’s tiers map cognitive barriers AAA pricing ignores. Eight bucks proves perfect: substantial enough for profit, low enough for ubiquity. Indie gold standard established.