Microsoft’s gaming empire took a beating. Q2 FY26 earnings show Xbox gaming revenue down 9% overall, with hardware sales cratering 32% year-over-year and content/services revenue declining 5%. The numbers land amid Switch 2’s launch dominance and reveal mounting pressure on Microsoft’s console strategy.

The Numbers Don’t Lie

Microsoft’s gaming division generated $623 million less revenue than last year’s Q2, driven by brutal declines across all segments. Xbox hardware suffered most, dropping 32% due to lower console volumes during holiday 2025. Content and services revenue fell 5% (6% constant currency), hurt by weaker first-party title performance compared to 2025’s powerhouse slate.

CFO Amy Hood called results “below expectations,” attributing declines to last year’s strong content calendar. Microsoft predicts similar single-digit drops in Q3 FY26 for the same reason. Meanwhile, the company’s overall revenue soared 17% to $81.3 billion, powered by Azure cloud growth.

Hardware Hell: 32% Console Decline

Xbox Series X|S sales continue freefall. Holiday 2025 saw 32% fewer consoles sold versus prior year, despite digital bundles and promotions. Microsoft expects this trend through calendar 2026, with no next-generation hardware announced.

| Segment | Q2 FY26 Change | Microsoft Explanation |

|---|---|---|

| Total Gaming Revenue | -9% | Lower hardware + weaker content |

| Xbox Hardware | -32% | Lower console volumes |

| Content & Services | -5% | Prior year had stronger 1st party |

XboxEra notes last year’s Q2 also declined 7% overall, suggesting structural issues beyond content cycles. Series X|S lifetime sales hover around 34 million per VGChartz, roughly double Wii U but far behind PS5/Switch.

Game Pass Growth Stalls, No Subscriber Update

Microsoft stayed silent on Game Pass subscribers since reporting 34 million in early 2024. Content/services decline despite recent price hikes suggests subscriber churn or flat growth. Call of Duty: Black Ops 7 reportedly underperformed versus Black Ops 6, hurting microtransaction revenue.

Despite gloom, Microsoft touts cross-platform success. Call of Duty: Black Ops 6 drew 50 million players. Minecraft hit record usage post-movie. Forza Horizon 5 and Oblivion Remastered topped US PS5 charts, proving multiplatform strategy yields sales.

Competition Crushes Holiday Sales

Switch 2 launch crushed Xbox holiday sales. Nintendo’s hybrid dominated with backwards compatibility and day-one Mario Kart 10. PlayStation 5 offered $100 discounts during Black Friday. Xbox raised Series X prices in September 2025, pricing out budget buyers.

Reddit users note Xbox claims 100% third-party revenue (distributing 70% to devs), inflating store numbers but masking hardware weakness. Battlefield 6 and Arc Raiders generated digital sales, but couldn’t offset console declines.

What Comes Next for Xbox

- FY26 Q3: Black Ops 7, Outer Worlds 2, Gaiden 4, Flight Sim 2025 (PS5)

- FY27 Big Bets: Fable reboot, Forza Horizon 6, Halo: Campaign Evolved

- No Next-Gen Plans: Leadership flip-flops on new hardware timing

- Multiplatform Push: More Xbox games on PS5/Switch confirmed

Microsoft maintains “nearly 40 games in development” despite canceling Everwild and other projects. Activision Blizzard acquisition continues delivering, but organic Xbox growth stalls.

Industry Context: Xbox Isn’t Alone

Console market contracts overall. PlayStation dominates hardware but faces software slowdowns. Nintendo thrives on hybrid appeal. PC gaming grows via Steam Deck ecosystem. Microsoft pivots toward cloud/services while hardware becomes loss leader.

Analysts question Xbox’s viability as standalone hardware brand. Multiplatform deals generate revenue but erode exclusivity. Game Pass growth stalls amid price resistance and content gaps.

FAQs

Why did Xbox hardware sales drop 32%?

Lower holiday console volumes versus strong 2025. Switch 2 launch, PS5 discounts, and September Xbox price hikes crushed sales during critical period.

Is Game Pass still growing?

No subscriber update since 34 million (2024). 5% content/services decline despite price hikes suggests stagnation or churn.

Did Call of Duty underperform?

Black Ops 7 reportedly lagged Black Ops 6 sales/microtransactions, contributing to content revenue decline.

When’s the next Xbox console?

No announcement. Leadership suggested pricey hybrid PC model, but timing unclear amid declining Series sales.

Are Xbox games going multiplatform?

Yes. Forza Horizon 5, Oblivion Remastered topped PS5 charts. More titles confirmed for PlayStation/Switch.

Will Xbox survive as hardware brand?

Microsoft prioritizes cloud/services revenue. Hardware operates at loss, subsidizing Game Pass ecosystem.

What Xbox games launch soon?

Q3 FY26: Black Ops 7, Outer Worlds 2, Gaiden 4, Flight Sim 2025. FY27: Fable, Forza Horizon 6, Halo Campaign Evolved.

Conclusion

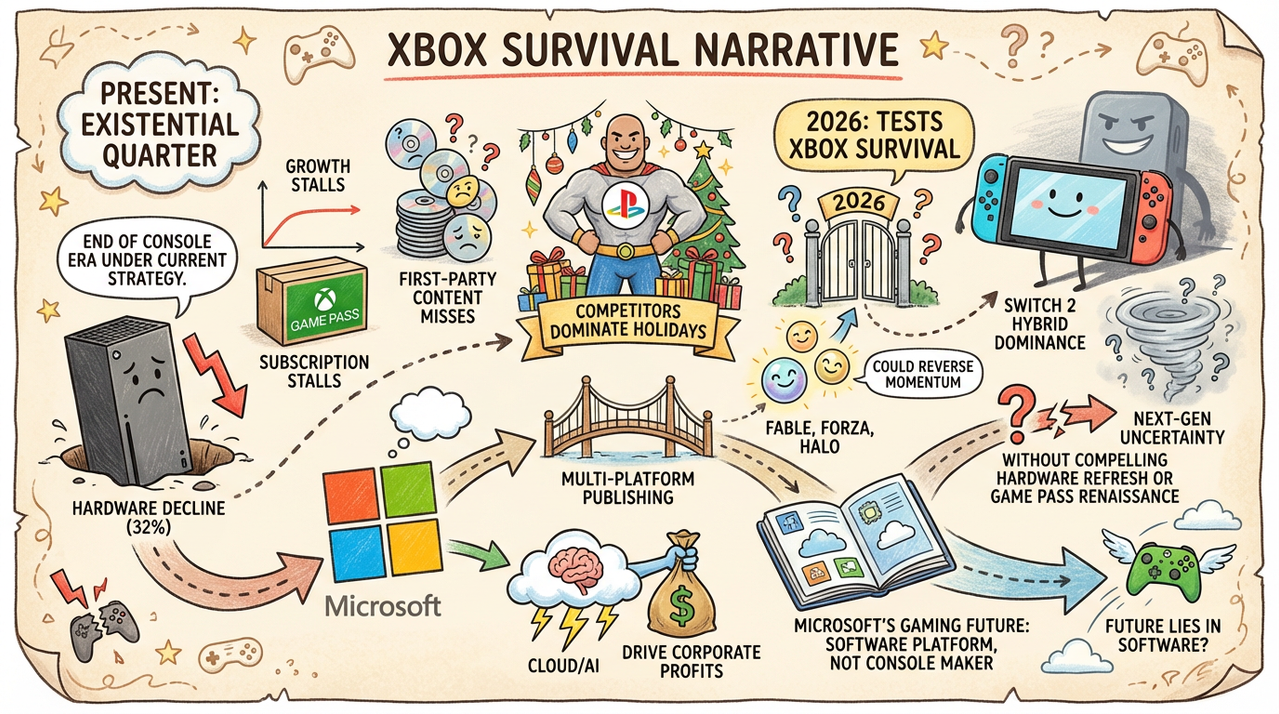

Xbox faces existential quarter. 32% hardware decline signals end of console era under current strategy. Game Pass growth stalls, first-party content misses expectations, competitors dominate holidays. Microsoft pivots toward multiplatform publishing while cloud/AI drive corporate profits.

2026 tests Xbox survival. Fable, Forza, Halo could reverse momentum, but Switch 2 hybrid dominance and next-gen uncertainty loom large. Without compelling hardware refresh or Game Pass renaissance, Microsoft’s gaming future increasingly resembles software platform, not console maker.